In many companies, finance departments are burdened with endless routine work, and CFOs are bogged down in operational tasks instead of focusing on strategic development. How can you eliminate the chaos in spreadsheets and improve communication within your team?

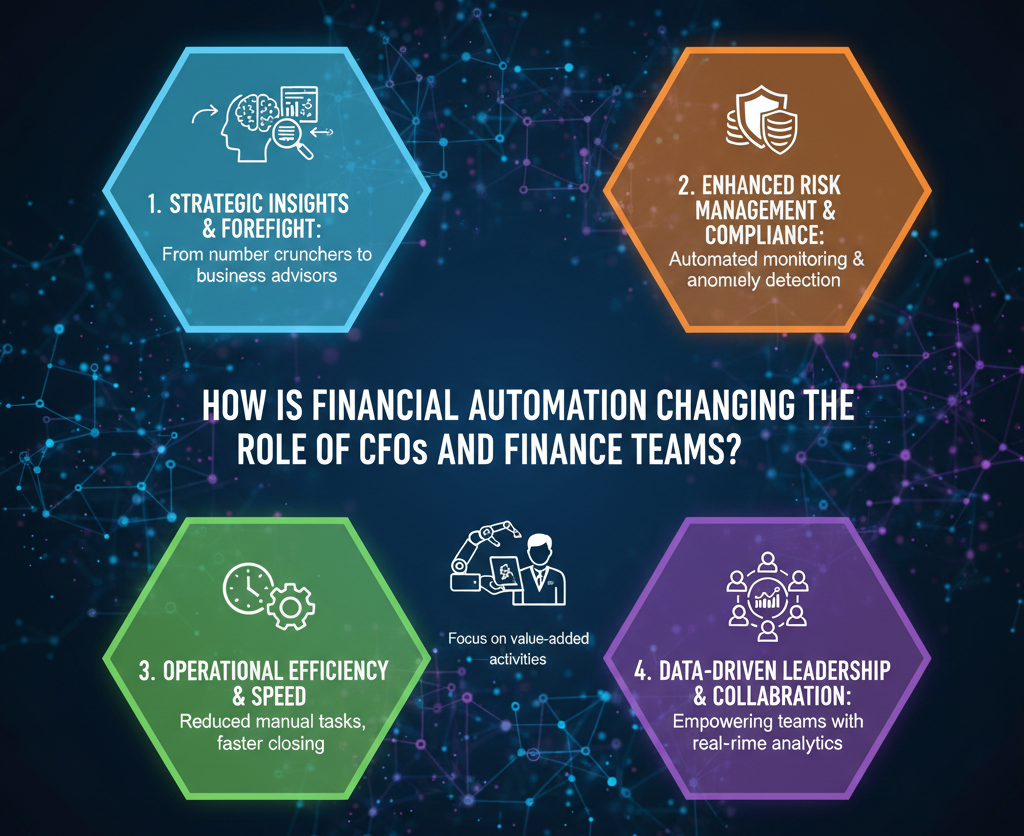

In this article, we explore how finance automation tools are changing work results, what exactly is changing, what role the CFO plays in the digital transformation of finance, and provide examples of automation that have had a real impact.

How does financial automation solutions change the way a team works?

The implementation of financial automation systems offers many advantages for CFOs (Chief Finance Officers) and finance departments. And we prove it with data and statistics:

- According to Ardent Partners “State of ePayables 2024” report, teams with automated accounts payable (AP) processing show 82% faster invoice processing (an average of 3.1 days instead of 17.4 with manual processing). The cost of processing a single invoice is reduced from approximately $12.88 to $2.78.

- According to a study published by Kefron in February 2025, automating financial management reduces the time spent on routine operations (invoice processing, data entry, approval, reconciliation) by 60-80%.

- Automated systems reduce the risk of human error, loss, or duplicate payments, and help maintain accounting accuracy and compliance, which is especially important in highly regulated and tax-intensive environments.

Therefore, digitization of finance and accounting automation optimize work processes, reduce time and costs, and increase data reliability and transparency.

Continue reading How Odoo ERP optimize processes, automate sales, and increase management transparency in IT? NuxGame case study

The transformation of the CFO role: from operations to strategic management

Who is the CFO and what role do they play in the company?

The CFO is a top manager who shapes the company's financial strategy and ensures its long-term profitability and sustainability. The manager is responsible for managing the company's finances, including budgeting, cost control, financial reporting, and supporting management decisions.

So, what changes for the CFO when finances are automated? First, the time it takes to complete tasks. The problem of manual data entry leads to delays in processes. Finance automation software helps them focus on analytics, cash flow forecasting, scenario modeling, and cost optimization instead of spending hours (or even days) processing invoices, approvals, reconciliations, and preparing reports.

Second, transparency and control are achieved. Automated systems immediately provide a single database where all transactions, accounts, approvals, and payments are stored. This ensures that the system always has up-to-date data to quickly respond to changes, analyze costs, counterparties, and cash flow, and identify weaknesses and risks.

Thirdly, quality control, risk reduction by eliminating the human factor in finance, and compliance with standards. Automation systems support document versions, action logging, automatic checks, validation, and payment and invoice matching, which significantly reduces the likelihood of errors or fraud. As a result, the role of the CFO is transforming from that of an “accountant-operator” to a “strategic financial leader” responsible for strategic financial planning.

Learn more about Drone Industry Outlook: U.S. & Europe Market Trends, Forecasts, and Key Players

Why should you automate finance? Key benefits

Today, finance automation companies go far beyond accounting. Thanks to automation and data centralization, finance becomes the basis for management decisions, risk control, and growth forecasting. Below are the key benefits that businesses gain from a mature financial system:

- accelerated financial reporting;

- cash flow control;

- data-driven decision making;

- reduced operating costs;

- continuous accounting;

- transparency of financial processes;

- business scaling through automation;

- real-time financial visibility;

- effective financial control.

In the long term, this builds financial discipline, increases trust in data, and allows businesses to scale without losing control.

Successful finance automation examples

Financial automation is not a myth. There are real companies that have already experienced its effects. Among them are:

- High-tech engineering company Stetman implemented Odoo. A fully customized accounting module was developed to replace outdated systems and support Stetman's compliance needs. As a result, the company manages all official accounting records and operations in Odoo, eliminating dependence on outdated platforms. More details at the link.

- An IT company and software provider implemented Odoo with the support of Self-ERP. The configuration of accounting and management accounting modules ensured accurate financial control and systematic tracking of expenses and income.ERP has enabled the company not only to streamline financial process automation, but also to lay the foundation for long-term growth and global expansion. Full case study available at the link.

These examples prove that finance workflow automation in any context provides real, measurable results and transparency of financial flows.

You might also like What Is Odoo WMS? Top 5 Features and a Practical Capability Overview

What should be considered when implementing automation?

It is worth noting that finance automation is not a magic button that you can press to start the process. To get the most out of it, we recommend following a few guidelines:

- Choose a system that can integrate with your current tools, including bank accounts, ERP/CRM, and accounting software. This simplifies the launch and reduces resistance from the team.

- Start with the most routine, narrow areas (processing bills, invoices, payments), and then scale up to budgeting, reporting, and analytics. This approach allows you to gradually adapt your team.

- Ensure proper internal processes, such as approval rules, access rights control, and exception handling, so that management accounting automation does not create new risks but, on the contrary, increases control and compliance.

And most importantly, communicate with the team. It is important to explain that automation primarily frees up time to work on value, development, and strategy, rather than replacing people. For growing companies, digital finance transformation turns finance from a back-office function into a strategic driver of business growth.

Conclusion

Financial automation transforms the role of the CFO and the entire team, shifting the business model toward flexibility, transparency, and strategic management. When financial processes are automated, the company gains stability in its routine, minimizes errors, enables fast and transparent payments, control, up-to-date reporting, and more.

For a manager, CEO, or business owner, this is an opportunity to make decisions faster and more informed, build a development plan, scale without a proportional increase in administrative costs, and invest in growth.

If you are still hesitating, calculate how many hours per month your IT, accounting, or finance teams can free up by putting routine processes on “autopilot.” For many companies, this can be a critical factor in determining their ability to grow and withstand competition.